Did you know that shipbuilding accounts for over $1.7 billion in economic output every year on the Gulf Coast? Yet, the true powerhouse behind this statistic lies in the Pascagoula shipyards, where Bolinger Shipyard and Ingalls Shipbuilding have carved out legacies that ripple far beyond the waterfront. This editorial cracks open perspectives rarely shared in the headlines, pushing past shipbuilding clichés to reveal how these two titans—side by side, yet worlds apart—are reshaping work, industry, and the very fabric of Pascagoula, MS. Whether you’re an industry insider, curious local, or investor, the stories and insights ahead promise surprises about the future of American shipbuilding on the Gulf Coast.

Revealing the Unmatched Impact: Bolinger vs Ingalls in Pascagoula, MS on the Gulf Coast Economy

Pascagoula isn’t merely a dot on the map—it’s the lifeblood of the gulf coast shipbuilding industry. When comparing bolinger vs ingalls in pascagoula, ms , one quickly sees that both organizations drive employment, innovation, and coastal prosperity at national scale. With contracts stretching from the U.S. Navy to Coast Guard security cutters and partnerships with the Senate Armed Services Committee , their combined influence fuels thousands of careers directly and creates ripple effects across local businesses and state tax bases.

Their output includes everything from modern combat ships and advanced submarine modules to vital cargo, auxiliary, and amphibious warships . Local communities benefit as well: Pascagoula’s housing, education, and infrastructure see visible changes with every multimillion-dollar contract announcement. It’s not just about employment numbers—the economic footprint of these shipyards shapes the future trajectory of the gulf coast industrial base, reinforcing Pascagoula’s status as a critical node in America’s defense and commercial maritime supply chains.

Examining the Numbers: Employment, Output, and Economic Influence

On the numbers front, Ingalls Shipbuilding stands as Mississippi’s largest private employer, clocking over 11,000 workers. Bollinger Shipyards (having recently acquired VT Halter Marine) brings decades of legacy and hundreds of high-paying jobs, especially as it ramps up in new areas like Polar Security Cutter construction. Wage totals from both companies surpass $500 million annually, supporting thousands of households along the coast and regularly drawing new residents to Jackson County and beyond.

Their output varies by specialty. Ingalls has delivered dozens of San Antonio-class amphibious ships , Arleigh Burke destroyers , and other military vessels, while Bollinger excels in fast response cutters and support ships for the Coast Guard and Navy. From tax revenue to supply chain purchases, the combined economic influence of these two shipyards ensures Pascagoula retains its spot as a true Gulf Coast industrial juggernaut—a status few coastal cities can match.

|

|

|

|

|

Comparative Overview of Bolinger vs Ingalls in Pascagoula, MS - Key Statistics |

|

Shipyard |

Employees |

Main Products |

Annual Output (USD) |

Key Partners |

|---|---|---|---|---|

|

Bollinger Shipyards |

1,300+ |

Security Cutters, Support Vessels |

$200M+ |

U.S. Coast Guard, Navy |

|

Ingalls Shipbuilding |

11,000+ |

Amphibious Warships, Destroyers |

$1.2B+ |

U.S. Navy, Senate Armed Services |

A Deep Dive into Bollinger Shipyard Strengths in Pascagoula’s Shipbuilding Landscape

Bollinger Shipyards may have only recently put down roots in Pascagoula, but its impact is rapid and far-reaching. This legacy builder is lauded for bringing advanced modular construction technologies rarely seen elsewhere on the gulf coast . By specializing in next-gen security cutter and polar security cutter programs for the U.S. Coast Guard and Navy, Bollinger ensures Pascagoula remains pivotal to national defense priorities dictated by the White House and the Senate Armed Services Committee .

Bollinger Shipyards’ track record in technical innovation stretches back decades across Louisiana and Florida. Now in Mississippi, responsible leadership means forging partnerships with local tech colleges, scaling up with diverse workforces, and delivering on critical deadlines. Whether assembling the skeleton of a security cutter or ensuring integration of cutting-edge green technology, Bollinger’s forward-thinking approach is a vital differentiator in Pascagoula’s crowded shipyard scene.

Bollinger Shipyard’s Legacy: Innovation and Growth on the Gulf Coast

“ Bollinger Shipyards have been the backbone of technical advancement alongside traditional expertise in maritime manufacturing on the Gulf Coast. ” As these words ring through boardrooms and weld shops alike, Bollinger’s commitment to both tradition and progress cannot be overstated. They have consistently delivered fast response cutters and specialty vessels that have raised the bar for the entire shipbuilding industry on the gulf coast .

This dual focus—on heritage and innovation—hands the company a competitive edge. Long relationships with the Senate Armed Services Committee and collaborative defense projects ensure that Pascagoula benefits not only economically but also through access to groundbreaking maritime practices. Bollinger’s approach represents a blueprint for balancing craftsmanship and hi-tech in today’s industrial landscape.

-

Advanced modular construction techniques

-

Strategic contracts with Senate Armed Services

-

Reputation for supporting US Navy’s evolving needs

Ingalls Shipbuilding: Long-Term Community Anchor in Pascagoula, MS

Ingalls Shipbuilding is woven into the cultural and economic fabric of Pascagoula. As a fixture on the gulf coast for generations, Ingalls has provided stability through highs and lows, serving as a reliable source of employment while also fostering a profound local identity. Their partnership with local high schools and colleges offers vocational pathways, while investment in the latest shipyard technologies ensures the region’s reputation as a center for maritime innovation.

Beyond economic metrics, Ingalls’ legacy is rooted deeply in its commitment to workforce training and community-wide prosperity. With decades-long experience guiding contracts through the Senate Armed Services and leading the way on complex projects—from Arleigh Burke destroyers to San Antonio-class amphibious warships —Ingalls stands as a gold standard for industrial leadership along the entire Gulf Coast.

Ingalls Shipbuilding Milestones: From Historic Contracts to Modern Warships

-

Largest private employer in Mississippi

-

Pioneering work with Senate Armed Services and U.S. Navy

-

Champions of engineering training programs

“The pride in Pascagoula is real – Ingalls Shipbuilding sets a gold standard for the region’s workforce and industrial leadership.”

When reviewing Ingalls’ achievements, consider its key role in supporting both the industrial base and the national security initiatives championed by the White House . This isn’t just about ships—it’s about sustaining an entire ecosystem. Each milestone represents advancements not only for Mississippi but for the wider United States defense community, ensuring that the region’s impact stretches far beyond Pascagoula city limits. Ingalls’ partnerships with federal entities, such as the Senate Armed Services Committee and collaborations with General Dynamics , ensure that their expertise is recognized, funded, and future-ready.

Bollinger Shipyards and the Competition: Facing Off Against Austal USA, Ingalls Shipbuilding, and More

Within the Pascagoula shipbuilding landscape, Bollinger Shipyards and Ingalls Shipbuilding face vibrant competition—notably from Austal USA, a key player known for its aluminum vessel expertise and rapid delivery . This Mobile-based contender has carved out its own market share with aluminum vessel expertise, fast deliveries, and partnerships spanning the private and public sector, including the armed services committee . Austal’s investments in next-generation combat ship programs and rapid manufacturing have raised benchmarks across the region.

What distinguishes Bollinger Shipyards and Ingalls Shipbuilding, however, is their direct influence on regional contract awards—especially those guided by the Senate Armed Services Committee . With a legacy of supporting both economic development and U.S. defense requirements, these Pascagoula mainstays ensure that local jobs, federal investments, and community programs remain protected from external market forces. The synergy and rivalry between Bollinger, Ingalls, and Austal actively drive up quality, accountability, and economic output for the entire Gulf Coast.

Key Players: Bollinger Shipyards, Austal USA, and Their Roles in Senate Armed Services Decisions

-

Bollinger & Ingalls’ influence on regional contracts

-

Austal USA’s distinct position in the market

-

Senate Armed Services’ impact on shipyard priorities

As the Senate Armed Services Committee charts the course for the Navy’s future fleet, their contract decisions elevate Pascagoula’s importance on the national stage, reinforcing the strategic roles of Bollinger Shipyards and Ingalls Shipbuilding. Bollinger shipyard and Ingalls Shipbuilding continually adapt their strategies, while Austal USA pushes the boundaries with innovation and speed. Local stakeholders—workers, technical schools, subcontractors—benefit from increased choices and opportunities, forging Pascagoula as the benchmark for shipbuilding excellence on the Gulf Coast.

Leadership Spotlight: The Influence of Kari Wilkinson and Executive Direction at Ingalls Shipbuilding

“Leadership moves mountains – Kari Wilkinson’s vision shapes every facet of Ingalls Shipbuilding’s future.”

Leadership at Ingalls Shipbuilding has always mattered, but the arrival of Kari Wilkinson as president marked a distinct turning point. Wilkinson’s leadership, characterized by pragmatic innovation, strategic long-term investments, and a fierce commitment to workforce development, has galvanized Ingalls in new ways. Her deep experience and trailblazing status as one of the few female leaders in the industry have set a new standard—making her influence felt not just within Ingalls but all along the Gulf Coast, where her style inspires workforces and signals to young professionals that Pascagoula is fertile ground for advancement.

Women Shaping Pascagoula’s Shipyards: Kari Wilkinson’s Transformative Years

Wilkinson’s tenure has accelerated implementation of technical innovations, broadened diversity initiatives, and secured funding for new engineering training programs—all points of pride for Ingalls and the broader Pascagoula area. Under her guidance, Ingalls has deepened its ties with major defense players, expanded relationships with allies such as General Dynamics and the Senate Armed Services Committee , and proven itself essential to current and future national security priorities.

As industry observers note, her approach is as much about culture as it is about contracts. Under Wilkinson, Ingalls has increased internal mentorship, expanded work-life balance programs, and set ambitious targets for workforce equity. These moves don’t simply modernize the workforce structure—they energize Pascagoula’s reputation as a premier destination for shipbuilding talent on the Gulf Coast.

Technology, Training, and Transition: Modernization at Bolinger vs Ingalls in Pascagoula, MS

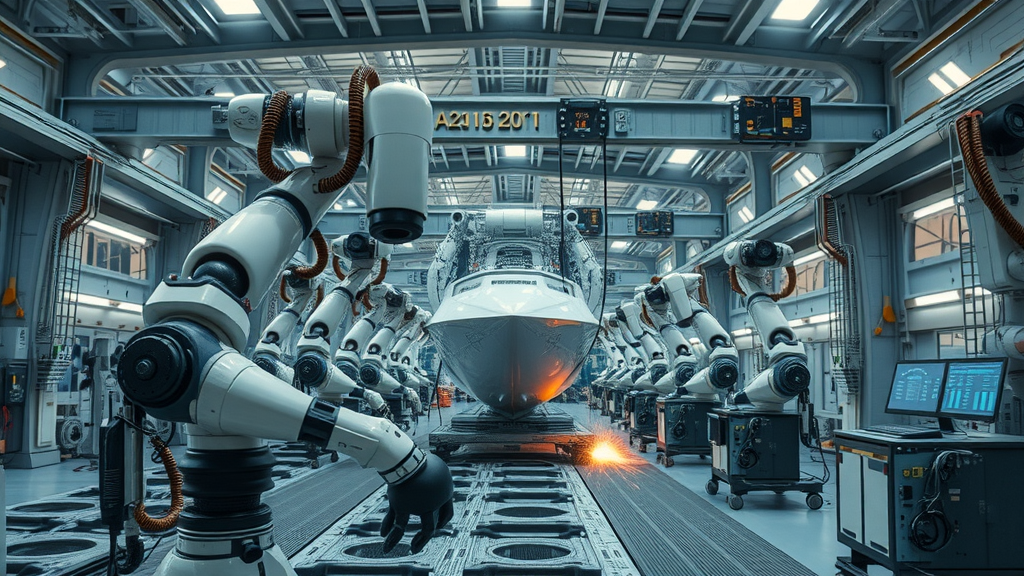

The modernization journey at Bollinger Shipyards vs Ingalls Shipbuilding in Pascagoula, MS converges on three pillars: modular construction, strategic training, and green innovation. Bollinger Shipyards leads with investments in robotic assembly, scalable ship module techniques, and partnerships with technology-focused trade schools. These advances significantly reduce build times, improve quality, and address evolving demands of the Senate Armed Services Committee and the White House’s National Defense Strategy .

Ingalls, for its part, places heavy emphasis on employee development through apprenticeships, career-path programs, and continuous skill upskilling. From advanced welding certifications to digital design labs, their strategy ensures the workforce remains future-ready—a necessity for keeping pace as amphibious warships , destroyers, and even submarine modules become more technically demanding. Both shipyards’ focus on sustainability—incorporating green power, waste reduction, and eco-friendly paints—positions Pascagoula as an emerging leader in responsible shipbuilding on the Gulf Coast.

-

Modular shipbuilding advancements at Bollinger Shipyards

-

Ingalls’ workforce development strategies

-

Embracing green technologies on the Gulf Coast

Future-Proofing Pascagoula’s Economy: Bolinger vs Ingalls in Pascagoula, MS

Securing Pascagoula’s future means constant adaptation. Both bollinger shipyards and ingalls shipbuilding are sharply focused on automation, smart manufacturing, and environmental stewardship—hallmarks of long-term industrial success. Their collaborative work with local colleges and innovative partnerships guarantee a pipeline of talent for the evolving needs of the armed services committee and private sector clients. Each investment in new technology safeguards Pascagoula’s stature as an indispensable hub for America’s military and commercial fleet refresh.

Community Impact: Bolinger vs Ingalls in Pascagoula, MS and the White House’s National Defense Strategy

The reach of Bollinger Shipyards vs Ingalls Shipbuilding in Pascagoula, MS goes far beyond ship hulls and waterfronts. Every contract secured helps fuel local and state budgets with increased tax revenue , supports thousands of jobs directly across the Gulf Coast, and creates even more via subcontractors and support services. As anchor tenants, both companies play central roles in the White House’s National Defense Strategy —delivering combat-ready ships and pioneering the technologies that keep the U.S. military ship fleet at the cutting edge.

In tangible terms, their impact is felt in business expansion, home construction, improved school funding, and robust community grants. Pascagoula’s small businesses—cafes, mechanics, logistics companies—thrive because of the steady work and optimism driven by these shipbuilding giants. With each new initiative aligned with national defense themes, Pascagoula continues to reinforce its identity as a linchpin in both local community health and American security assurance.

Direct Economic Contribution: Local, State, and Federal Benefits

-

Tax revenue for Jackson County

-

Job creation across Gulf Coast

-

Support for White House defense initiatives

When analyzing economic ripple effects, it’s clear the combined presence of bollinger shipyards and ingalls shipbuilding sustains a large portion of Jackson County’s employment and economic vitality. Whether measured by new home sales, local technical school enrollments, or regional infrastructure improvements, the benefits of Pascagoula’s shipyard activity extend throughout the state and even influence regional strategies set forth by the White House and Secretary of the Navy alike.

What Sets Bolinger vs Ingalls in Pascagoula, MS Apart From Other Regional Employers?

-

Senate Armed Services contracts

-

Partnerships with the Gulf Coast technical community

-

Investments in work-life and diversity programs

Unlike many traditional regional employers, Bollinger Shipyards and Ingalls Shipbuilding don’t just offer jobs—they provide careers that carry prestige, purpose, and pathways for advancement. These organizations are uniquely situated to secure and fulfill immense federal contracts (armored by their connections to the Senate Armed Services Committee ), offer state-sponsored and in-house training programs, and lead the charge in workforce diversity and employee well-being. It’s a formula few can replicate, and it’s what keeps Pascagoula at the sharp end of the industrial base in America.

People Also Ask: How Many Employees Work at Ingalls Shipbuilding?

Ingalls Shipbuilding employee count and workforce demographics in Pascagoula, MS

Ingalls Shipbuilding employs over 11,000 people in the Pascagoula area, making it the single largest private employer in the entire state of Mississippi. This workforce is renowned for its diversity, ranging from seasoned veteran shipbuilders and engineers to recent high school graduates enrolled in apprenticeship and mentorship programs. The demographic mix illustrates Ingalls’ decades-long commitment to opening doors for women, minorities, and military veterans alike—sustaining Pascagoula’s reputation as both a hub of skill and an engine for economic stability.

People Also Ask: Who Owns Ingalls Shipbuilding?

Corporate ownership structure and strategic partnerships behind Ingalls Shipbuilding

Ingalls Shipbuilding is owned by Huntington Ingalls Industries , a publicly traded corporation deeply embedded in the defense sector. As a subsidiary, Ingalls has access to Huntington’s vast financial and technical resources, enabling seamless strategic partnerships with major government entities (like the Senate Armed Services Committee , White House , and Department of Defense ). This ownership structure underpins Ingalls’ ability to deliver complex vessels, invest in long-term workforce development, and compete vigorously for the world’s most critical maritime contracts.

Expert Analysis: Pros and Cons of Bolinger vs Ingalls in Pascagoula, MS

|

|

|

Side-by-Side Comparison Table: Bollinger Shipyards vs Ingalls Shipbuilding |

|

Factor |

Bollinger Shipyards |

Ingalls Shipbuilding |

|---|---|---|

|

Key Strengths |

Modular construction, fast delivery, adaptability |

Scale, tradition, training, cutting-edge warship production |

|

Major Contracts |

U.S. Coast Guard cutters, security vessels |

San Antonio-class, Arleigh Burke destroyers, submarine modules |

|

Workforce |

Smaller but growing, skilled trades focus |

Largest in MS, highly diverse, multiple training pipelines |

|

Innovation |

Advancing automation and green tech |

Workforce upskilling, process digitalization |

|

Community Impact |

Growing presence, partnerships with technical colleges |

Economic anchor, major philanthropic programs |

|

Potential Challenges |

Scaling to match established comp, new market integration |

Legacy systems, competition for federal contracts |

FAQs About Bolinger vs Ingalls in Pascagoula, MS

-

What new contracts have Bollinger Shipyards secured? Bollinger Shipyards has secured several significant contracts in recent years, including the construction of Polar Security Cutters for the U.S. Coast Guard and advanced support vessels for the Navy. These contracts are part of ongoing partnerships with federal defense agencies and are expected to significantly increase Pascagoula’s employment and technical capacity.

-

How is Ingalls Shipbuilding responding to workforce changes? Ingalls Shipbuilding is investing heavily in workforce modernization, including expanding apprenticeship and re-skilling programs, increasing workplace diversity initiatives, and enhancing compensation packages to remain competitive. These efforts ensure that Ingalls is prepared for evolving technological and industry demands, as well as creating a culture of continued learning and opportunity.

-

What are the latest environmental initiatives at these Gulf Coast shipyards? Both Bollinger and Ingalls have rolled out new environmental policies focusing on reduced emissions, advanced waste management, energy efficiency upgrades, and the adoption of eco-friendly paints and materials for ship construction. These initiatives help position Pascagoula at the forefront of green shipbuilding and support both local and national sustainability goals.

Summing Up Bolinger vs Ingalls in Pascagoula, MS and the Gulf Coast’s Shipbuilding Future

“Shipbuilding isn’t just metal and muscle – it’s the spirit of Pascagoula and the Gulf Coast, embodied in every vessel that sails out.”

Take action now—connect with local industry leaders and seize the opportunities that only Pascagoula’s shipyards can offer.

Ready to Explore Careers or Partnerships with Bolinger vs Ingalls in Pascagoula, MS?

-

Visit https://gulfcoasttech.net/ for opportunity overviews, resources, and expert connections

Sources

-

https://ingalls.huntingtoningalls.com/ – Ingalls Shipbuilding Official Site

-

https://bollingershipyards.com/ – Bollinger Shipyards Official Site

-

https://www.gulfcoasttech.net/ – Gulf Coast Technology Center

In Pascagoula, Mississippi, two prominent shipbuilders, Bollinger Shipyards and Ingalls Shipbuilding, significantly contribute to the Gulf Coast’s economy and the U.S. maritime industry.

Bollinger Shipyards expanded its operations in 2022 by acquiring VT Halter Marine and ST Engineering Halter Marine Offshore, renaming them Bollinger Mississippi Shipbuilding and Bollinger Mississippi Repair. This strategic move enhanced Bollinger’s capacity to construct high-performance vessels for both government and commercial clients. Notably, in March 2025, Bollinger secured a $951.6 million contract modification from the U.S. Coast Guard to advance the Polar Security Cutter program, marking the first heavy polar icebreaker construction in half a century. ( bollingershipyards.com , nolanewswire.com )

Ingalls Shipbuilding , a division of Huntington Ingalls Industries, has been a cornerstone of Pascagoula’s shipbuilding landscape for over 85 years. Emplore than 11,000 workers, Ingalls is the largest manufacturing employer in Mississippi. The shipyard specializes in building amphibious ships, guided missile destroyers, and national security cutters for the U.S. Navy and Coast Guard. Recent investments have modernized the facility, incorporating advanced automation and climate-controlled workspaces to enhance efficiency and capacity. ( hii.com , news.usni.org )

Both shipyards face challenges in workforce development amid a surge in shipbuilding demand. The competition for skilled labor is intense, with both companies implementing training programs and partnerships with local educational institutions to attract and retain talent. These efforts are crucial to maintaining their roles in national defense and economic growth along the Gulf Coast. ( defensenews.com )

In summary, Bollinger Shipyards and Ingalls Shipbuilding are pivotal to Pascagoula’s economy and the broader maritime industry. Their ongoing projects and strategic initiatives underscore the region’s significance in U.S. shipbuilding and defense.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment