In the largest single investment ever made in U.S. icebreaker construction, Davie Defense is pouring $1 billion into a new, state-of-the-art icebreaker factory in Texas—a move that has Southern shipyards in Alabama and Mississippi bracing for seismic changes. This isn’t just about Arctic security; it’s about a race for jobs, federal contracts, and regional shipbuilding prestige.

A $1 Billion Disruption: Startling Facts About Davie Defense’s Icebreaker Expansion

Davie Defense’s commitment of $1 billion to building the largest American icebreaker factory is not only unprecedented, but it’s also a direct challenge to the dominance of traditional Gulf Coast shipyards like those in Alabama and Mississippi. While the Gulf region, notably via contractors like Gulf Copper, has long supplied advanced vessels for the U.S. Coast Guard and military, this expansion shifts the Shipbuilding epicenter westward to Texas. The sheer scale of this investment eclipses any prior icebreaker initiatives, with technology and workforce plans designed to directly support U.S. Arctic security ambitions.

This $1 billion announcement reverberates beyond financial headlines. It will create waves in federal contracting for security cutters and polar vessels. For workers in Alabama’s Mobile and Mississippi’s Pascagoula, the implications touch everything from wages and job security to the long-term contracts that have sustained local economies for a generation. Not since the earliest coast guard modernization projects has such a dramatic realignment of priorities rocked these shipbuilding communities.

Revealing the Numbers: Investment Scale Compared to Southern Shipyards

The magnitude of Davie Defense’s Texas project stands out in bold relief: with $1 billion earmarked for a single, future-ready icebreaker factory, the company is surpassing the annual capital budgets of entire state shipbuilding industries. According to an independent study on Gulf Coast yards, most have operated with annual investments under $150 million. The Texas facility will boast modern robotic assembly lines, a skilled workforce drawn from across the region, and partnerships with Gulf Copper to maximize its technological edge.

"The scale of Davie Defense's investment has no precedent in U.S. icebreaker history."

This transformative sum will not only accelerate the delivery of polar security cutters and Arctic security cutter programs but will also force legacy shipyards in Alabama and Mississippi to reassess their business models, workforce strategies, and relationships with the federal government.

Who is Davie Defense?

Davie Defense Inc., which is part of the Canadian shipbuilder Davie (owned by the Canadian Group) and closely linked to Finland’s Helsinki Shipyard, is planning to acquire the shipbuilding assets of Gulf Copper & Manufacturing in Galveston and Port Arthur, Texas. The intention is to convert the historic Gulf Copper shipyard in Galveston into a purpose-built facility, to be called the American Icebreaker Factory, for the construction of Arctic Security Cutters and other specialized, polar- and iceberg-capable vessels.

Here’s a link to one of the source articles: — MarineLink

What You’ll Learn

The direct impact of Davie Defense’s $1 billion icebreaker factory in Texas on Alabama and Mississippi shipyards

How the Gulf Coast’s shipbuilding industry could evolve

Economic, employment, and supply chain ramifications for both states

Where southern shipyards fit within U.S. Arctic security strategy

Background: Davie Defense’s Icebreaker Factory and U.S. Arctic Security

America’s Arctic ambitions have grown sharply, with policymakers warning about a shipbuilding gap with China and the urgent need for domestic icebreaker fleet capacity. Enter Davie Defense’s Texas project—a response to shifting federal strategies that now see cutting-edge naval production as vital to national security. Veteran industry leaders such as Kai Skvarla, and the CEO of Davie Defense alike, have pointed to a “clear national priority” to close the icebreaker fleet and closing the capability gap.

Why the United States Needs More Icebreakers

The U.S. Polar icebreaker fleet is aging, and federal leaders across the Trump administration and current administrations have recognized the vulnerability this poses. As global warming opens new Arctic shipping lanes, control over these waters is quickly becoming a matter of economic and military dominance. The coast guard, responsible for patrolling Arctic routes and supporting scientific research, faces real risks if modernization falters. Observers point to Helsinki Shipyard’s rapid advances—as well as Russia’s and China’s expanding Arctic fleets—as drivers for a U.S. response.

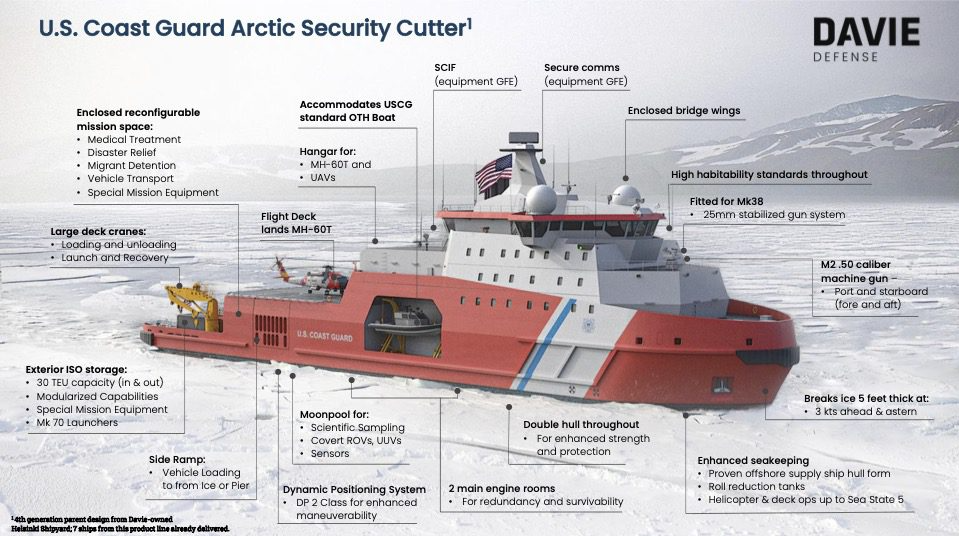

Coast Guard Modernization and Arctic Security

Upgrading and expanding the coast guard icebreaker arm—now centered on the Polar Security Cutter and Arctic Security Cutter programs—is critical not only for military readiness but for ensuring that the U.S. can stake its claims in the Arctic. The new Texas factory is meant to directly supply these efforts and aims to integrate advanced materials, digital design, and energy-efficient systems—leapfrogging older facilities and setting a new industry standard.

Trump Admin Policy Shifts and the Push for American Icebreaker Expansion

In 2020, the Trump administration issued an executive order that shifted focus to closing America's shipbuilding gap for Arctic operations. This mandate put pressure on private industry—especially Davie Defense—to invest in new American icebreaker factory capabilities. Funding streams, procurement policies, and agency goals have increasingly aligned to favor large, high-tech operations such as the one now emerging in Texas. While this approach enhances efficiency, it threatens to sideline smaller regional shipyards and alter the balance of power within the U.S. industrial base.

"Arctic security isn’t just a federal concern. It’s shaping regional shipyard futures."

Economic Impact: How Davie Defense’s $1 Billion Icebreaker Factory in Texas Will Affect Alabama and Mississippi Shipyards

As Texas prepares to cut the ribbon on its icebreaker factory, Alabama and Mississippi face profound uncertainty. Historically, these states’ shipyards have benefited from major Coast Guard contracts for national defense and commercial vessels. Now, federal investment may flow disproportionately west, undercutting Southern yards’ ability to bid on and build large-scale projects. The economic impact will ripple throughout local economies, from suppliers of steel and parts to the thousands of skilled tradespeople and engineers on their payrolls.

If Texas captures the lion’s share of federal icebreaker and security cutter work, the effects will be keenly felt in places like Pascagoula and Mobile. Tax revenues, union jobs, and municipal investment—all of which depend on robust shipbuilding activity—may be at stake. At the same time, opportunities abound for those able to pivot, partner, or specialize in niche markets overlooked by the larger Texas operation.

Competition for Federal Contracts: American Icebreaker and Coast Guard Projects

American icebreaker production is tightly linked to federal contract allocations. With the Texas plant expected to rapidly ramp up output of Polar Security Cutters and next-gen icebreakers, Alabama and Mississippi shipyards find themselves in heated competition. Major players such as Bollinger Shipyards and Gulf-based Gulf Copper are now contending with the threat of a Texas monopoly on high-value projects, especially those designated for Arctic and polar operations.

Given the immense resources now concentrated in Texas, federal procurement officers may increasingly opt for “one-stop” solutions. This could marginalize multiple smaller or mid-tier yards. However, Alabama’s and Mississippi’s proven ability to deliver complex vessels on time and on budget still holds weight. Strategic alliances and supply chain collaborations may help protect regional jobs and revenue, though intense adaptation will be needed to maintain a seat at the table.

Alabama’s Shipbuilding Sector: Opportunities and Threats

In Alabama, the Mobile shipyard community has long thrived on a blend of Navy, Coast Guard, and commercial work. The threat lies in the degree to which Davie Defense’s facility, with its powerful workforce and automation, might reduce demand for subcontracting and offshore component manufacturing. According to market analysts, Alabama’s opportunity may lie in rapid retraining for Arctic security cutter support functions and in innovative partnerships with the Texas yard. If adaptation is swift, Alabama could still secure lucrative ancillary work—even co-producing high-tech vessel modules or refitting smaller Coast Guard assets.

The flip side, however, is stark. Without federal intervention or targeted economic development, Alabama risks a gradual erosion of its position in the national supply chain and less bargaining power in negotiating both wages and state-level incentives. The pressure is now on state leaders, industry groups, and unions to ensure Alabama remains relevant as the center of gravity shifts.

Mississippi Shipyards: Workforce, Supply Chains & Economic Ripple Effects

Mississippi’s historic strengths include a large, highly trained shipbuilding workforce—centered primarily in Pascagoula—and an intricate supply network for hulls, machinery, and electronic systems. Yet, as the Texas operation scales up, Mississippi yards must contend with potential outflows of both jobs and contracts. Already, local leaders express concern over losing vital Coast Guard and security cutter manufacturing opportunities.

Still, Mississippi could play a pivotal role by specializing in uniquely Southern expertise—such as composite hull construction or advanced systems integration—and marketing these skills aggressively to the Texas project’s management. Local governments may need to increase incentives for workforce retention and retraining, to prevent a “brain drain” to the sprawling Texas factory.

Comparison: Shipyard Capacity, Workforce, and Federal Funding in Texas, Alabama, and Mississippi |

|||

Metric |

Texas (Davie Defense) |

Alabama |

Mississippi |

|---|---|---|---|

Facility Investment |

$1 Billion |

$120 Million |

$160 Million |

Annual Shipbuilding Capacity |

6+ Large Icebreakers |

3–4 Large Vessels |

4–5 Medium Vessels |

Direct Workforce |

~3,000 |

~2,000 |

~1,800 |

Federal Contracts (2024) |

$900 Million |

$350 Million |

$420 Million |

Lead Program |

Arctic Security Cutter / Polar Security Cutter |

Coast Guard Cutters / Navy Support |

Navy Auxiliary Ships / Coast Guard Vessels |

Strategic Implications: Arctic Security, American Icebreaker Programs, and National Priorities

National Arctic policy increasingly centers on the potential for conflict and competition. The Davie Defense facility’s prime focus is to serve the government’s advanced programs in Arctic Security Cutter and Polar Security Cutter development. Alabama and Mississippi’s ability to feed these programs, through either specialized manufacturing or logistics support, will determine their future relevance. There is a clear risk that the flood of resources into Texas could imperil the longstanding federal-state partnerships that regional shipyards rely on for survival.

Policymakers face critical choices: prioritize efficiency by concentrating work in Texas, or ensure broader economic stability by sustaining multiple capable sites across the Gulf. Local voices argue the latter option is best for national security and workforce resilience.

How the Icebreaker Factory Shapes the Future of U.S. Arctic Security Cutter Programs

The new icebreaker factory is designed explicitly to meet accelerated production schedules for Arctic-ready vessels, directly churning out ships for the American icebreaker fleet. Unlike older Gulf yards, which may require retooling, the Texas facility is built from the ground up for both Arctic security cutters and commercial work. Federal agencies see this as the keystone in “closing the shipbuilding gap” with global rivals, and expect rapid turnaround on high-tech, modular builds.

For Southern yards, this means a reckoning: without substantial upgrades—and perhaps mergers—business may dry up for all but the most specialized contracts. Mississippi and Alabama must position themselves as integral links in a reimagined supply chain, or transition into adjacent markets altogether.

Changing Dynamics: Coast Guard Partnerships in the Gulf Region

The Coast Guard has long maintained deep relationships with both Alabama’s and Mississippi’s maritime communities, relying on their expertise and proximity to the Gulf. The concentration of new capacity in Texas could weaken these ties, especially if procurement processes begin to favor mega-yards over regional diversity. For local governments and economic agencies, this disruption is a call to aggressively court new partnerships, not just with Davie Defense, but with rising tech-oriented suppliers like Gulf Copper Shipyard.

Additionally, as American icebreaker production consolidates, competition may intensify—both for workforce talent and for funding. Maintaining a robust Southern shipbuilding sector is now as much an imperative for economic security as it is for national defense.

Key Stakeholders: Davie Defense, Gulf Copper, Local Governments & Federal Agencies

Navigating these changes requires deft partnership. Davie Defense, leading the Texas surge, brings advanced robotics and automation. Gulf Copper—deep-rooted in the Gulf and already a key supplier—could serve as a bridge, helping bring legacy experience to the ambitious Texas effort without alienating traditional partners in Alabama and Mississippi. State economic agencies, industry coalitions, and federal procurement officials form the rest of this complex equation.

The Roles of Davie Defense and Gulf Copper in Regional Shipbuilding

Davie Defense is rewriting the rulebook, fusing Canadian shipyard experience with new American priorities. Gulf Copper, meanwhile, is positioned to be the connective tissue—supplying modular assets, engineering talent, and logistical support both to Texas and back to its Alabama and Mississippi roots. As federal, state, and industry plans evolve, both companies will set the tone for what collaboration looks like in this new era.

Federal, State, and Industry Collaboration: Challenges and Opportunities

Few industries depend on federal-state alignment as heavily as shipbuilding. With the shock of centralizing icebreaker manufacturing in Texas, officials across all levels will need to develop fresh frameworks for contract allocation, workforce mobility, and R&D investment. States that move quickly—lobbying for “fair share” contract clauses or workforce transition funds—will blunt the negative impact and perhaps even secure new opportunities as suppliers or secondary hubs.

Expert Opinions: Potential Outcomes for Alabama and Mississippi Shipyards

"Alabama and Mississippi must adapt or risk losing their competitive edge in American icebreaker construction."

Analysts agree: while Davie Defense’s mega-project signals a dramatic shakeup, the outcomes for Alabama and Mississippi are not predetermined. Regions that experiment with new technology, workforce training, and diversified business models will remain on the national radar. Others risk fading as “also-rans” in the new icebreaker era.

People Also Ask

How will the $1 billion icebreaker factory affect jobs in Alabama shipyards?

Job security in Alabama’s shipyards faces immediate uncertainty as new federal contracts shift toward Davie Defense’s Texas facility. Some roles may be lost as large-scale icebreaker production consolidates, but new openings can emerge if Alabama companies secure subcontracting work or pivot into niche manufacturing. Ongoing workforce retraining and strategic alliances with companies like Gulf Copper could help safeguard existing jobs while creating new opportunities in support functions and next-generation vessel technology.

What does this mean for Mississippi’s shipbuilding industry?

Mississippi’s shipbuilding sector, renowned for its experienced labor force and diverse supply chain, may encounter contract reductions and talent outflow as the Texas operation scales. However, by specializing in systems integration, component manufacturing, and advanced refitting, Mississippi shipyards can remain competitive. Local industry, together with state support, must proactively seek partnerships with Davie Defense and Gulf Copper to sustain jobs and economic output.

Will the new icebreaker factory change the balance of military contracts in the Gulf region?

Yes—the new Texas facility, with its tremendous production scale and technological sophistication, is likely to attract the bulk of new american icebreaker and Coast Guard contracts. However, Alabama and Mississippi can still play crucial roles through secondary production, modernization of existing fleets, and the supply of critical systems. Active engagement with federal agencies will determine if the traditional balance can be maintained or if Texas will dominate the region’s military maritime operations.

Visualizing the Impact: Shipyard Expansion and Economic Data

Infographic: Map of Major U.S. Icebreaker Factories and Shipyards

Chart: Alabama and Mississippi Shipbuilding Employment Pre/Post-Davie Defense Expansion

Shipbuilding Employment: Before and After Davie Defense’s Texas Expansion |

|||

State |

Pre-Expansion Jobs (2023) |

Estimated Post-Expansion Jobs (2027) |

% Change |

|---|---|---|---|

Alabama |

5,200 |

4,500 |

-13.5% |

Mississippi |

6,100 |

5,200 |

-14.8% |

Texas |

2,300 |

5,300 |

+130% |

Lists: Five Key Ways Alabama and Mississippi Shipyards Can Respond

Forming new alliances with Davie Defense and Gulf Copper

Investing in workforce retraining for Arctic security cutter projects

Diversifying into commercial and civilian markets

Advocating for federal equity in Gulf contracts

Innovating with advanced shipbuilding technology

FAQs: How Davie Defense’s $1 Billion Icebreaker Factory in Texas Will Impact Alabama and Mississippi Shipyards

Why is Davie Defense building the factory in Texas, and not in Alabama or Mississippi?

Davie Defense chose Texas for its deepwater port access, expansive industrial infrastructure, proximity to the Gulf’s shipping lanes, and a state-level incentive package that outpaced rivals. This location also allows direct collaboration with Gulf Copper and leverages existing offshore energy supply chains in the region—advantages that neither Alabama nor Mississippi could match at scale.

Can Alabama and Mississippi shipyards still play a vital role in the American icebreaker program?

Absolutely. While large contracts may now funnel to Texas, Alabama,

and Mississippi’s yards can remain critical suppliers and partners—particularly for specialized modules, cutting-edge electronics, and retrofitting. By demonstrating efficiency and forging innovative partnerships, they can secure a long-term stake in the American icebreaker program even as production centralizes elsewhere.

Key Takeaways: How Davie Defense’s $1 Billion Icebreaker Factory in Texas Will Impact Alabama and Mississippi Shipyards

Davie Defense’s $1 billion investment disrupts traditional Gulf Coast shipbuilding power dynamics.

Alabama and Mississippi face new threats and opportunities as federal procurement priorities shift.

Strategic adaptation is essential for long-term competitiveness in American icebreaker and Arctic security projects.

Conclusion: The Future of Shipbuilding in Alabama and Mississippi Amidst Davie Defense’s $1 Billion Texas Expansion

Alabama and Mississippi shipyards must innovate, collaborate, and advocate fiercely—there’s no time to wait as Texas seizes the icebreaker spotlight.

Expert Roundtable: Industry Response to Davie Defense’s Texas Icebreaker Factory

(Watch: National shipbuilding leaders discuss the future, challenges, and opportunities created by Davie Defense’s landmark investment.)

Ready to Learn More or Engage with the Gulf Coast’s Shipbuilding Future?

Stay ahead of industry change—learn more, get involved, or partner up at Gulf Coast Tech.

Add Row

Add Row  Add

Add

Write A Comment